As Drone Stocks Skyrocket, Cathie Wood Can’t Get Enough of This 1 Name

The drone industry has captured investor attention as autonomous systems are poised to reshape sectors such as defense and logistics, among many others. Cathie Wood's ARK Innovation ETF (ARKQ) reflects this conviction, with Kratos Defense & Security Solutions (KTOS) commanding the second-largest position at 10.31% of the portfolio.

While Tesla (TSLA) is the ETF’s top holding at 13.60%, Kratos is Wood's biggest bet on pure-play drone technology. The defense contractor specializes in unmanned aerial systems, satellite communications, and microwave electronics—technologies that are critical, as military conflicts demonstrate the strategic value of autonomous platforms.

Kratos Defense & Security Solutions operates as a defense technology company serving national security markets through two main segments: Kratos Government Solutions and Unmanned Systems.

It develops satellite ground control systems, jet-powered unmanned drones like the Valkyrie and Thanatos, hypersonic vehicles including Dark Fury, and propulsion systems for missiles and spacecraft.

Kratos also produces microwave electronics for radar and missile defense, counter-drone systems, and virtual reality training platforms. Their diverse product portfolio supports programs like Powered JDAM and MACE while serving the U.S. Department of Defense, intelligence agencies, international governments, and commercial customers across critical defense and space applications.

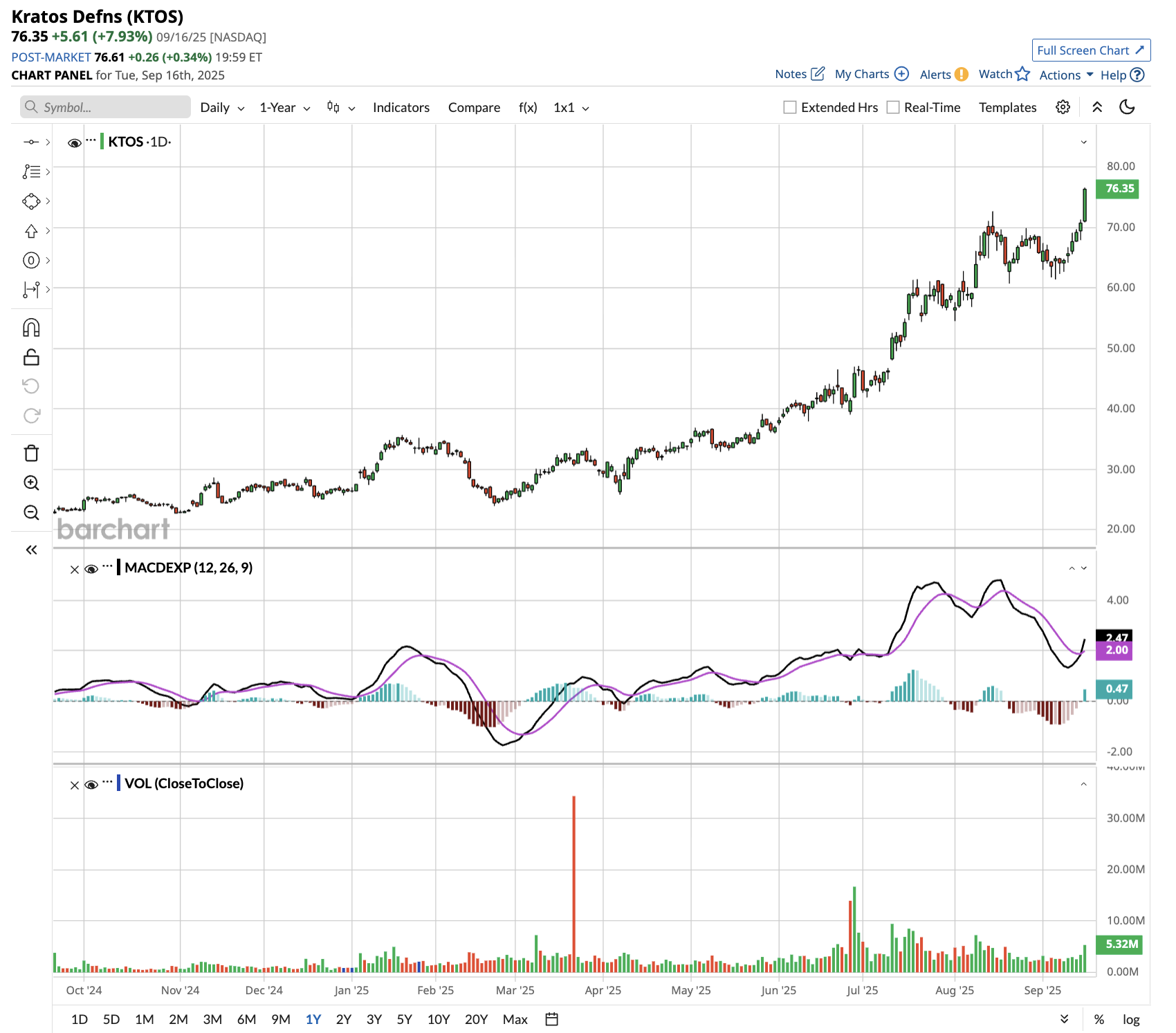

Valued at a market cap of $12.88 billion, KTOS stock is up 236% in the last 12 months. Let’s see if it is still a good buy right now.

The Bull Case for Investing in KTOS Stock

Kratos Defense & Security Solutions delivered impressive second-quarter results that exceeded expectations across all business segments. It reported revenue of $351.5 million, above its midpoint guidance of $305 million. The defense contractor reported organic revenue growth of 15% and raised its full-year midpoint guidance to $1.3 billion, indicating continued momentum in the global defense spending surge.

The company's performance was driven by strong execution across its hypersonics, microwave electronics, and tactical drone portfolios. Adjusted EBITDA of $28.3 million also beat estimates of $23 million, despite margin pressure from fixed-price contracts in the unmanned systems division. Management increased full-year EBITDA guidance to $117 million and expects margins to expand by at least 100 basis points in 2026.

Kratos announced two significant contract wins after quarter-end that could reshape its growth trajectory. The Poseidon program, a sole-source military hardware contract worth approximately $750 million through production, provides validation of the company's manufacturing capabilities.

Production is expected to begin ramping up in mid-2027 once required facilities are operational. Additionally, Kratos was selected for another program of record opportunity called DMOS, positioning third-quarter bookings for substantial growth.

The tactical drone business continues to gain traction as the Valkyrie system advances toward becoming a program of record for the U.S. Marine Corps. Airbus (AIR.FP) recently partnered with Kratos for European Valkyrie deployment, targeting the German Luftwaffe by 2029. The company maintains 15-20 Valkyrie aircraft ready for immediate delivery upon contract award, with management citing the potential for $150 million in immediate revenue from a hypothetical 15-aircraft order at $10 million each.

With global defense spending approaching $2.5 trillion annually and NATO allies agreeing to increase defense expenditure targets to 5% of GDP, Kratos appears well-positioned to capitalize on this generational recapitalization cycle. A proven track record of delivering operational systems, rather than concepts, has attracted customer interest and led to sole-source positioning opportunities.

Is KTOS Stock Overvalued Right Now?

Analysts tracking KTOS stock forecast revenue to increase from $1.13 billion in 2024 to $2.26 billion in 2029. In this period, adjusted earnings are forecast to expand from $0.49 per share to $1.58 per share.

In September, KTOS stock trades at a lofty forward price-to-earnings (P/E) multiple of 118x, which is above the five-year average multiple of 51x. If KTOS reverts to its historical mean multiple of 51x, the stock will trade around $81 in early 2029, which is above the current trading price of $76.

Out of the 16 analysts covering KTOS stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average KTOS stock price target is $68.53, indicating a downside potential of over 10%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.